Words by Sam Kimbley

The Chinese billionaire Jack Ma recently reappeared after a long absence from the public eye. Ma’s departure from public appearances began in October, and coincided with his criticism of Chinese financial regulators, which sparked much speculation about the reason for his public withdrawal.

In the first sighting since his disappearance, Ma appeared on a livestream on 20 January praising rural teachers in China in association with his rural teacher initiative, a part of his wide-ranging charity foundations.

During the livestream, he stated that during this time he had been focusing on “learning and thinking” and told teachers that “we will meet again” once the pandemic has died down to honour teachers in person.

This led to a rise in confidence from investors, who were reassured by the reappearance as it stopped the speculation about his fate. Many thought that he had fled the country, according to sources from The Guardian, but others believed he was just laying low.

The disappearance from the public view happened following criticisms of Chinese financial regulators and the Chinese Banking system at a conference in October. He criticised the lack of innovation within the Chinese financial sector and its inability to adapt to today’s issues.

At the conference, Ma said “we can’t use yesterday’s methods to regulate the future”, referring to the focus of the financial system which he said needs to move away from “risk control” and more towards “development” to solve the problems of today.

Ma further explained how he wants the banking system to work for the poorest members of society and remove the monetary barriers that prevent poorer people from gaining access to loans and other financial services.

Within two weeks of these comments, which are said to go against the Chinese Communist Party’s views, Ma was summoned by financial regulators. During this time, Ma’s Ant Group was supposed to launch its IPO (initial public offering), but this was abruptly halted at the last minute by Chinese financial regulators.

Regulators cited “changes to the financial technology regulatory environment”, but many analysts such as Bill Bishop believe it was a punishment for comments that he made at the conference in October.

Ant Group was not the only organisation that was hit with problems during this time, as regulators also set their sights on Tencent, a technology group that owns a variety of high value products such as the popular messaging app WeChat.

Regulators have since launched further attempts to rein in what it calls “suspected monopolistic practices” by Alibaba Holdings, Ma’s organisation that Ant Group was spun off from.

Analysts believe that Ma’s problems with financial authorities are only just beginning. According to sources at the Financial Times, there is speculation authorities are hoping to “break up Ant Group.” Sources also told the paper that the Peoples Bank of China is drafting rules which will lead to the reigning in of Ma’s financial organisations.

Preventing the Ant Group IPO from launching was significant. Multiple sources were ready to declare it the world’s largest IPO, valued at $313 billion, but since the events of the past months that valuation has been slashed.

Jack Ma is also a significant figure himself in China, starting life as an English teacher but rising quickly within the business world. Utilising the possibilities of the Internet, he went on to launch the Alibaba group which facilitated business to business transactions in China; Ma’s businesses only grew from there.

Ma was a popular figure within China according to the New York Times’ Li Yuan, and was associated with “success”, but public opinion has since been changing according to Yuan. This change in opinion appears to mirror his shifting status with financial regulators.

Only time will tell how this story will unfold, but analysts including Rupert Hoogewerf believe that it will no longer be “business as normal” for Jack Ma.

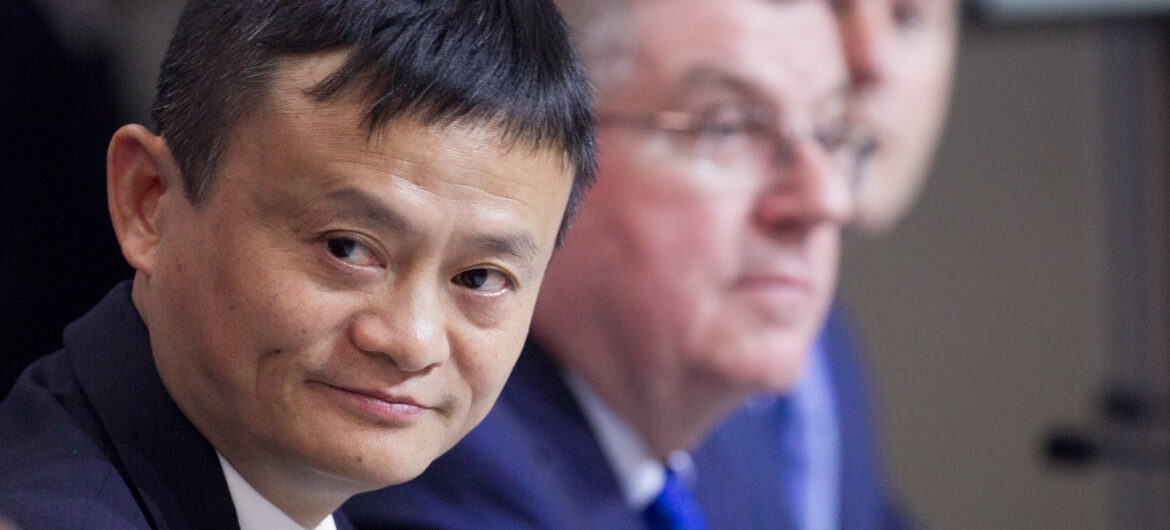

Picture Credit: World Economic Forum