The Government have announced plans to alter the repayment and interest rate for student loans.

These were set out as part of the Autumn Statement and the Spending Review for 2015, which outline the spending plan for the next four years.

Currently, they pay 9% interest rates, and only after their earnings have crossed the £21,000 threshold.

However, the Autumn Statement sets out that the repayment threshold will be frozen until April 2021 for everyone who has taken out a student loan after 1st September 2012.

Freezing the repayment threshold will “effectively increase borrower’s payments in real terms” according to Martin Lewis from Moneysavingexpert, who chaired the Independent Taskforce on Student Finance Information.

Critics fear that existing students and high earning graduates will be charged less interest under the new system, while people earning around or below the repayment threshold will see their interest rates rise.

Martin Lewis claims that “millions of graduates will pay more” for their education. He emphasizes that 95% of people consulted by the Independent Taskforce on Student Finance Information “opposed it”.

The government’s change will not simply affect current and future students, but also any graduates who attended university after 2012. Lewis says that this retrospective change means that the government has “mis-sold education to many students.”

Some students were not aware that laws had changed in 2012, allowing the government to retrospectively change the laws around student loans. One third year Economic student at Sussex said: “I didn’t even realize the interest rate on my student loan was adjustable at the whim of the government”.

The Badger asked the University of Sussex about its stance on Lewis’s position and how Sussex would make sure their students were prepared. A University spokesperson said: “The full implications of the Government’s Autumn Statement and what it means for the Higher Education sector are not yet clear, as some specific details are still to be announced. However, the University agrees and sympathises with students who have raised their concerns about Government-funded loans and the impact that repayments will have over the long-term.”

The University assured us that they “are in contact with the relevant organisations to understand the full implications of the Government’s announced changes and how best to provide information to support students on this matter”.

One concern raised by Sussex students is that those who graduate into lower-paid jobs will be at a disadvantage as it will take them longer to repay their loans and they will thus incur greater debts. A fist year Music tech student said: ‘I will probably get a low paid job on the ‘national living wage’ or such. The added tax will lessen my income, restrict my disposable income to spend on things and hinder my plans to become a musician. So, the more I pay in loan repayments, the less chance I will have to actually use my music tech degree. I took this degree to advance my knowledge in this, it is something I am very passionate about, but it means less money to buy equipment like a computer, audio interfaces or building a home studio.”

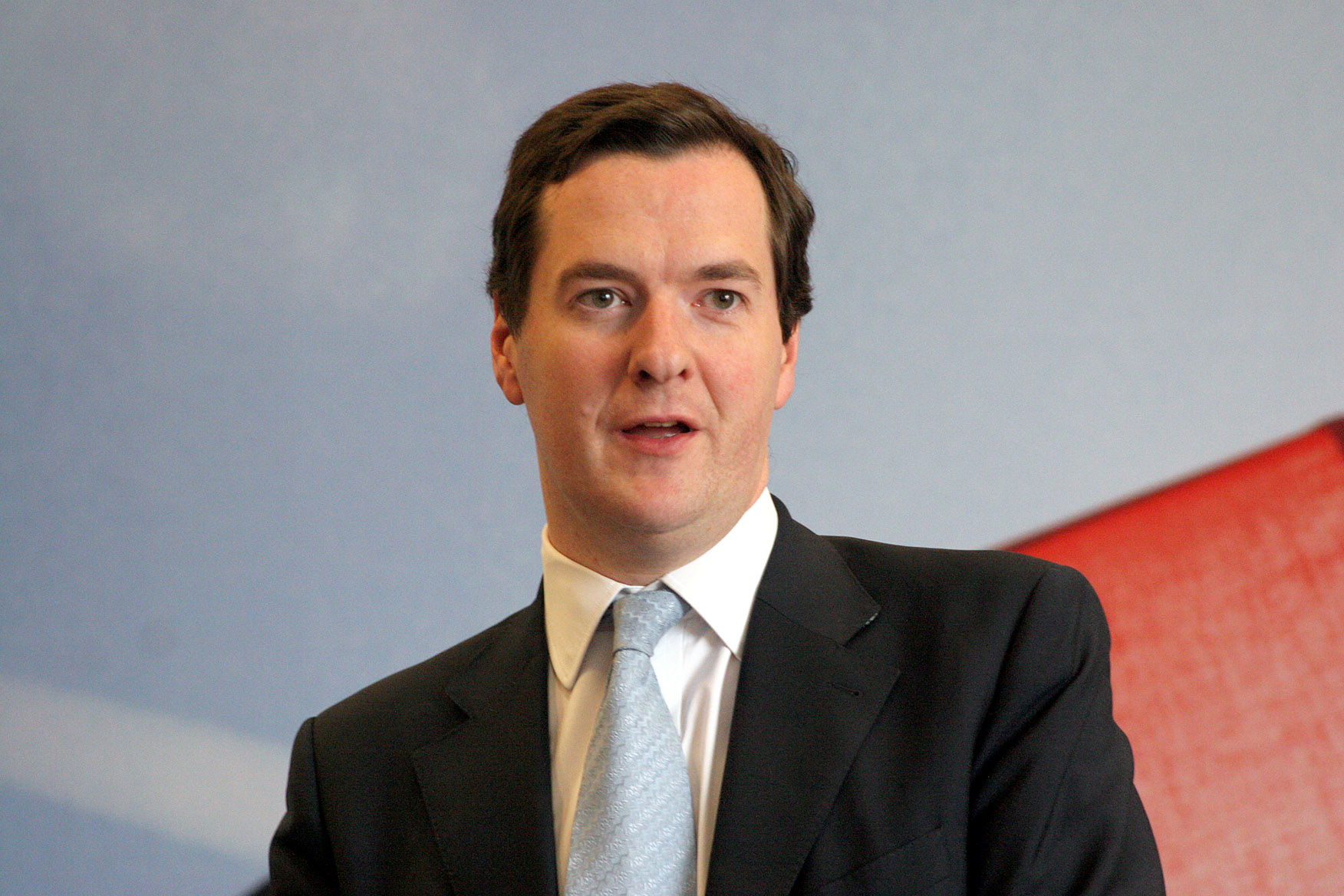

Chancellor of the Exchequer George Osborne announced the Spending Review, which this change is part of, in the House of Commons by reiterating that the Government is “committed to running a surplus”. He said: “Today, I can confirm that the four year public spending plans that I set out are forecast to deliver that surplus, so we don’t borrow forever and are ready for whatever storms lie ahead… This year our debt will fall and keep falling in every year that follows. We promised to move Britain from being a high welfare, low wage economy to a lower welfare, higher wage economy.”

Freya Marshall Payne News Editor